In my previous post, I wrote about some common ways that investors valuate real estate investments. In this post, I want to add some of my personal experience in how I choose investments.

My overall strategy is to identify properties that are listed at a discount, which often need renovations or repairs. Fixing up a property and then renting it is a value-add opportunity and can lead to higher returns. I think of my strategy in two parts: subjective and objective factors. The more subjective factors include location desirability and features of the property itself. The objective factors are more related to the calculations that I’ve explained before, but with some modifications.

Subjective Factors

Location

No real estate decision can be made without considering the number 1 rule: location! There are several factors I consider. I generally look for properties in areas where I would personally live, but I also have more specific guidelines:

- I prefer properties in walkable urban neighborhoods, close to shopping and public transportation. This is a desirable quality for rental properties as well since many urban tenants tend to not own vehicles.

- Properties in areas rapidly-appreciating (“gentrifying”) areas can offer the most bang-for-buck and high long-term appreciation. Of course, identifying these areas is easier said than done. For established desirable neighborhoods, I don’t have to do as much due diligence. For “transitional” or more risky areas (or areas I just don’t know as well), I take a look at houses that have sold in 3-6-12-24 month timeframes. This allows me to not only research recently sold comps, but also see if there is a positive trend in neighborhood property values. If I am purchasing in a lower-class neighborhood, I like at least the immediate houses to not be blighted.

- A property on a flat street is a plus!

Property Features

In terms of the property itself, I am usually willing to buy at any condition or configuration. But certain qualities of a property can make them more or less desirable than others. Here are a few examples:

- Exterior construction: I am willing to pay more money for a brick or stone (preferably unpainted) house compared to a house with siding. The problem with siding is that low to mid range siding materials, like vinyl, last for a short period of time and aesthetically look terrible. Higher quality siding material like fiber cement, composite wood or real cedar wood can be very durable, but must be continually repainted (every 10-15 years). Unpainted brick and stone is practically maintenance-free and last indefinitely. Repointing can be a large expense, but a repointing job can last a long (50+ years) time.

- Lot: houses on larger lots are generally preferable to those on smaller lots. “Bumpy” lots with a lot of hills and slopes are also less desirable than flat or slightly sloped lots. This factor doesn’t affect rental rates per se, but can play a role in the long-term value of the property.

- Condition of mechanicals/roof: Having these items in good condition is certainly ideal, but you usually can’t hope for the best when buying 100-year old fixer-uppers! Typically with homes that haven’t been completely neglected, there have usually at least been some updates within the past 10 years. For HVAC in particular, I prefer homes with AC or at least forced air. Adding air conditioning in a house with no ductwork can be very costly.

- House layout: Home layout is important and be costly to change, although a bad layout isn’t as much of a big deal if I’m planning a major renovation anyway. With that said, kitchen and bathroom layout and size can play a deciding factor for me. Is the kitchen big enough to support modern appliances? Is there more than one bathroom in the house? If so, where are they located?

- Off-street parking: I like for properties to have a garage, or at least a driveway or a place to put vehicles. If no off-street parking is available, I try to see if the lot is big enough to at least add a parking pad.

Objective Factors

After finding a property that meets some of the criteria above, I start to take a close look at the numbers and potential return on investment.

Since I’m typically looking for properties that need to be renovated, I look at the investment from two points of view: the After Repair Value (value of property after repairs and renovations, also known as ARV), and potential rent after repairs (ARR, if you will 😉 ).

In terms of ARV, the first few steps are to determine the value of the property as-is, estimate the renovation costs, and estimate potential value after renovations. Of course, websites like Zillow have helped me a lot with finding comps. I like to follow the 70% rule to help guide my decision, which states that the purchase price + renovation costs of a property should not exceed 70% of ARV. However, I am okay with going a bit above my planned renovation budget as I am a buy-and-hold investor and plan to keep my properties indefinitely.

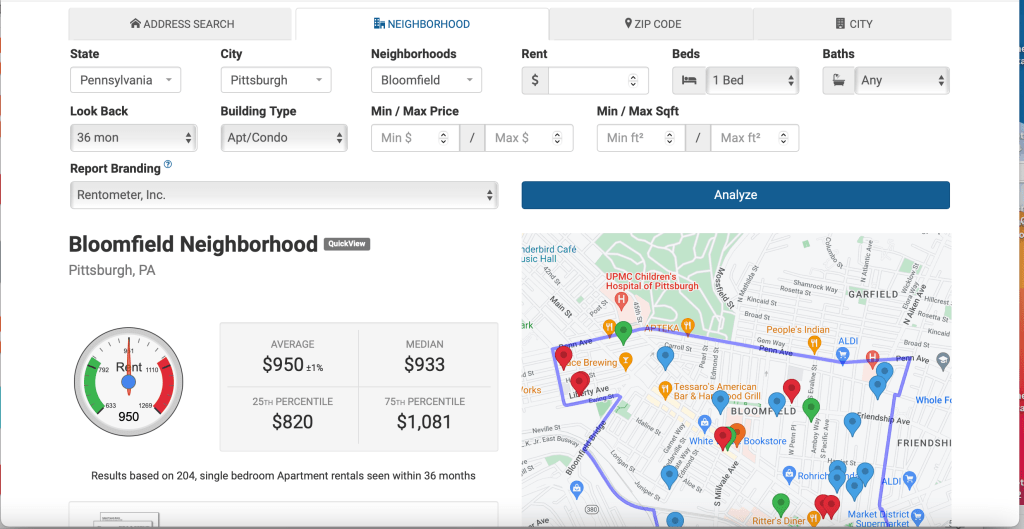

To estimate rent income, I like to use rentometer.com. I also check rental listings on Zillow (particularly those for updated units) to give me a rough idea.

You will notice that for the following calculations, I consider the purchase price + renovation costs rather than just purchase price. The problem I have with just using purchase price is that it does not adequately reflect the investment costs with a rehab property. You can often spend more than the purchase price on rehab. So in my case, I use some modified versions of common metrics.

“Modified” 1% rule

The 1% rule is one of the simplest and most common ways to evaluate rentals. The idea is that the monthly rent of a property should be at least 1% of its purchase price. For example, a property with a purchase price of $150000 should rent for at least $1500/month.

I like to use https://www.rentometer.com for this, but I also check Zillow to get a pulse on the rental market. Once I have a rough estimate, I like to see that the rent is at least 1.2%-1.5% of property price + renovation costs.

Example

Purchase Price: $100000

Rehab Costs: $60000

Total Cost: $160000

Ideal Monthly Rental Income: $1920-$2400 (1.2%*160000 – 1.5%*160000).

“Modified” CAP rate

For turn-key properties, CAP rates between 5-8% are considered realistic. But when you are willing to rehab a property in poor condition, it’s certainly possible to earn a greater return on investment. In my version of CAP rate, I use the purchase price + renovation costs instead of just purchase price. I look for my modified CAP rate to be at least 10%.

Example

Purchase Price: $100000

Rehab Costs: $60000

Total Cost: $160000

If rents are $1920/month, and operating costs are $200/month, the monthly net income would be $1720/month. The NOI would be $1720*12 = $20640. Therefore, the “modified” CAP rate would be $20640/$160000 * 100 = 12.9%.

Cash-on-Cash

Finally, there’s Cash-on-Cash. I look for CoC returns of at least 15% for any property in consideration.

Conclusion

So this is my personal process for selecting investment properties! If this sounds time-consuming, that’s because it is! However, it’s better in my opinion to really make sure the numbers will work before jumping into a life-changing decision. I have been able to identify properties that check most of my boxes, but it does require a bit of work.

What’s your process for evaluating investments? Let me know in the comments.

Leave a comment